Do you have to pay taxes on bitcoin

How Do You Calculate Your Crypto Taxes?

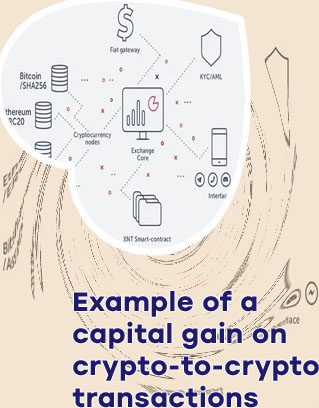

Is trading one cryptocurrency for another a taxable event

Your taxes on cryptocurrency gains will depend on your holding period, resulting in a short-term capital gains tax rate or a long-term capital gains tax rate. Summary of possible tax and National Insurance treatments of cryptoassets Keeping a detailed log of cryptocurrency transactions can help you prepare for tax season. As a best practice, your cryptocurrency log should include the following transaction information for every cryptocurrency wallet your business uses:

Do I have to pay crypto taxes for play-to-earn games like Axie Infinity?

Do you pay taxes on crypto trades

However, even if you meet all the above conditions, you must still keep records of any cryptoasset transactions. In addition, it is a good idea to calculate your gains or losses each tax year in any case, so you have an up-to-date record of the cost (for tax purposes) of your cryptoasset holdings. This will mean it is easier for you to work out if you owe capital gains tax in a future tax year. What is a non-taxable crypto event? Taxes are due after a sale, trade or disposal of cryptocurrency if there is a gain or even a loss. If you sell or trade the cryptocurrency for a profit, you pay taxes on the gain like other assets. The same is true with non-fungible tokens; a capital gain or loss should be reported for taxes.

- What is a crypto wallet

- History of cryptocurrency

- Bnb on cryptocom

- Cryptomafia

- Bitcoin game

- Most viewed crypto

- How to get money out of crypto com

- Hokk crypto

- Etherium future

- Best bitcoin exchange

- Buy kda crypto

- Crypto nerds are trying buy us

- Should i sell my dogecoin

- Where to buy ufo crypto

- How to buy coc crypto

- Gala crypto

- Why was bitcoin created

- Dogecoin volume

- Crypto login

- How does bitcoin make money